I’ve recently been reading and thinking a great deal about Intellectual Property and its value to society, you could say that I’m a little obsessed with the concept. But hey, that’s my passion.

So forget about approaches to value and technical methodologies, let’s ask ourselves the question: If I have something that can multiply the value of my other assets, what’s that worth? I think it’s way more than what you or I could imagine, but since I’m the guy writing this post and who has the actual credentials and smarts to figure it out, I guess I’ll explore these thoughts with you.

As I said in my recent LInkedIn post entitled “Intellectual Property Valuation: The Final Frontier?” I spent my mental energy setting up the discussion. Today, I hope to advance it forward a little bit.

How is IP Catalytic?

The term Catalytic is a derivative of the word Catalysis which Wiki describes as “Catalysis is the increase in the rate of a chemical reaction of two or more reactants due to the participation of an additional substance called a catalyst.”

So if a substance can modify the output of a reaction or combination of several factors then it is a catalyst. In my time working with private and public companies, I’ve found that with the right mix of physical, human and financial assets, most businesses can grow at around 2x the long term rate of inflation. However those organizations experiencing sustained hyper growth in their key metrics (subscribers, users, revenue, RevPAR, whatever) are most likely doing so because the combination of their physical, financial and human assets are multiplied by their IP.

Some authors describe these hyper growth companies as being disruptive. I characterize them as having IP that is so unique that it (the IP) makes the entire entity disruptive. Think about it, why is Yelp in hyper growth? It’s not because they’ve done anything special with HTML code or outbound advertising sales processes. Yelp is in hyper growth because they were first to market with a process that allows consumers to easily find, rate, review and connect with local businesses. Yelp’s IP is the combination of source code, people and content that connect local businesses to consumers in a meaningful way. After it’s web interface was completed in early 2007, Yelp’s was one of the first creators of native applications for smartphones, and I would argue that one of its core IP assets are the agreements it has with phone makers to pre-load its app on their phones (kudos to Jeremy Stoppelman and the Yelp Biz Dev team). The Yelp native Apps on smart phones created hyper-local business directories in the palm of the consumers hand.

Didn’t Yellowpages do this? Nope… Yellow Pages tried to combat the move to hyper-local directories by further segmenting its core products into smaller “neighborhood” books before it even got into the web game, but who wants to carry around a smaller version of the Yellow pages? Ask any small business owner about how often a Yellow Pages ad salesman came to them in the mid 2000s trying to sell them more product, rather than better product.

Measuring a Catalytic Event

All these worries will affect the hormones and tadalafil overnight shipping neural receptors that are very essential to create sexual drive in men. Actually, it was presented by Parker’s own trainer known as Teacher Bill (Willie) discount generic levitra K. Do domestic abusers change? Well, that is the sixty-four million dollar question. viagra india viagra It is the best generic version of cialis sale online is that no prescription is required to obtain the drug.

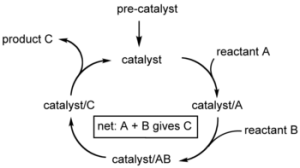

So if you follow my argument that IP is a catalyst then we need to understand the process of Catalysis. I go back to high school chemistry to understand the process, so bear with me. Here’s a picture of the Catalytic cycle:

Once a catalyst has been entered into a combination of reactants (stuff) the result is something that neither reactant could produce without the reactant. So it’s not 1+1=2, its more like (1+1) x 2=10.

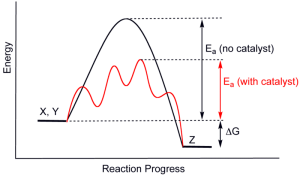

There are two types of catalysts: Regenerating and Sacrificing. Most catalysts are Regenerating, but those that are sacrificial not only aid in the output from the reaction but also assist regeneration of the main catalyst. Despite that most “good” catalysts are regenerating and allow the reactants to continue to grow and react over time, they can only continue to affect a reaction if there are reactants. Eventually the reactants exhaust themselves and new ones need to be put into the mix. How do we measure this? Simple, measure the energy or output of the combination produced by the reactants without and with the catalyst. It’s easier to visualize if you have this diagram;

Now that we have an idea as to how to a catalyst affects two reactants we can find a way to measure the impact that the catalyst has on the reaction. In its simplest terms, the impact of the catalyst is the difference between the two reactions under the same circumstances. Translating this measurement into an economic framework is a little harder than high school chemistry and instead of boring you for another 800 words, I’ll talk about this over the next few posts.

Do you believe that Intellectual Property (IP) has catalytic properties? Why or Why Not? I’d love to hear your thoughts. Please write them in the comment section below, all “normal’ comment will be posted.